Weekly Reflection for April 21, 2023

- Serene Point

- Apr 20, 2023

- 5 min read

The Week - An Update in Charts

Markets traded sideways throughout the week as investors digested "meh" corporate earnings reports and strong-ish data on the economy. With only a few weeks to go before what is expected to be the final rate-raising decision by Federal Reserve, stock prices lacked momentum.

A poll by Barron's asked where how professional money managers were positioned in equities for the next 12 months. It was a three-way tie with roughly a third each answering bearish, bullish or neutral. Managers were also about equally divided on whether bonds or stocks would perform better over the next 12 months.

Take a look - this might just be about has high as things get. The market odds are 88% in favor of a 0.25% increase in the Federal Funds rate in May. After that, and per the Fed's own words, a 1% cut in rates in 2024 may also be coming.

Some have compared Russia's invasion of Ukraine to a home invader who comes in, takes over a room and then proceeds to wreck most of the rest of the house. They do not take over the entire house, but make it very miserable to continue habitation.

A year into this home invasion, many of Ukraine’s allies are still exporting goods to Russia. In the next steps to get Putin to the negotiating table, the world's largest economic powers are asking countries to ban all exports to Russia.

A ban on exports to Russia will hurt but for now, Europe's economy is recovering. Services are growing the most with manufacturing still looking a bit sluggish. Experts say the region may avoid a recession with help from easing energy concerns, easing inflation and improving supply chains. Australia and Japan’s economies also look stable.

Covid learning losses have persisted. Although both Math and English scores are improving, U.S. school children are still behind their 2019 peers. Researchers concluded that government education policies on how teachers teach have helped certain states recover quicker than others. Using phonics in English has been a huge predictor of success; although Math scores have recovered more sharply, there is no particular success factor.

Earth Day is tomorrow and talk of renewable energy sources is at the forefront. In terms of capacity, the U.S. has the second most wind power behind China and the most geothermal installed capacity. Wind and solar are growing the most, but together are just 5% of our supply. Still, we have not moved the needle much on use of renewables as a percentage of

consumption in 20 years.

Commercial Debt Dilemma

Volumes have been written about the massive number of loans coming due on commercial properties over the next two years. The line being repeated in the news is “almost $1.5 trillion of US commercial real estate debt comes due for repayment before the end of 2025.” Given that the total commercial debt outstanding is roughly $4.5 trillion, it appears 30% of building owners tookloans at exactly the same time. That is somewhat true but not the complete picture.

Like residential, commercial real estate debt is secured by a lien on the property by the borrowers, usually businesses in this case and not individuals. There are two types of loans – an "intermediate" maturity of about three years and "long" maturity from five to 20 years. A 20% down payment is common and repayment terms generally require monthly payments over the loan life and a significant balloon payment for the balance due at the end of the term. Before that balloon payment occurs, the borrower usually refinances with either the current or a new lender, or sells the property. This is normal, not usually anything to worry about. But gone are the days of steadily increasing property values and low or decreasing interest rates. There is also the worry about banks’ abilities to lend, especially the mid-tier banks most vulnerable to the problems that caused the bankruptcy of Silicon Valley Bank.

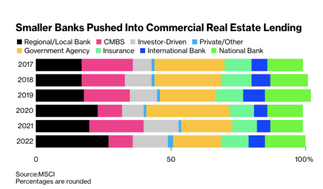

In just the last six years, the combined lending of government and large international and national banks, once 50% of the market, has given way toregional banks, and private funds and

investors. It is uncertain how willing they will be to stay in the game and refinance given the environment. Thus, the panicky headlines.

FTX + Bitcoin + Shaq = A Mess

Shaquille O’Neal does not seem like someone who would scare easily. After 30 years in the public eye, nearly 20 of them on the court as an NBA star, the 7-foot, 300-pound athlete seems like he would have seen more than his fair share of good and bad publicity to have toughened up by now. But apparently, he was so shaken by his involvement with FTX that he spent five months hiding inorder to avoid contact with the legal team that sought to serve him in a fraud lawsuit brought by investors in the defunct cryptocurrency exchange FTX.

“A lot of people think I’m involved, but I was just a paid spokesperson for a commercial,” the basketball champ explained to CNBC late last year.

A paid spokesperson in this case is a big deal. Larry David, Tom Brady and Gisele Bundchen were also just paid spokespersons. Kevin O'Leary was paid some $15 million to just speak about the wonders of FTX.

Last November FTX's house crumbled and it now stands accused of defrauding investors in an $8 billion scheme. FTX was supposed to allow its customers to buy and exchange cryptocurrencies such as Bitcoin, Ethereum and Binance Coin, among hundreds of other digital coins. But FTX founder Sam Bankman-Fried and his team were extraordinarily sloppy with their accounting and ethical practices – borrowing from this customer over there to pay for this bad bet over here, and so on, engaging in a basic Ponzi scheme. You can read the details of the epic downfall here.

Although it initially seemed uncertain whether any of the $8 billion lost could be recovered, lawyers at FTX’s bankruptcy hearing this month shared that $7.3 billion has been recovered. Per FTX attorney Andy Dietderich, "the situation has stabilized, and the dumpster fire is out." The fire is out and FTX is considering restarting its business in 2024. Gulp.

FTX and its fleet of attorneys can give credit to an impressive rise in the price of Bitcoin and Ethereum, two of the most widely held and most important coins in the crypto universe. Both have been crucial in helping FTX in the valuation of recovered assets as they are up some 70% from their November lows. Enthusiasts claim that “primarily inflation and the outlook for interest rates” have pushed up the prices - although that explanation is tired and senseless. Crypto has followed technology stocks up and is more likely tied to a growing appetite, again, for risk rather than any hedging strategy. Nonetheless, it has helped FTX out of its quagmire.

As for Shaq, he is still in trouble along with a host of other celebrity mouthpieces. Unfortunately for him, he is on record telling CNBC of digital currencies, “I don’t understand it, so I will probably stay away from it until I get a full understanding of what it is … From my experience, it is too good to be true.” If he did gain an understanding and invested his speaking fees back into FTX, as Kevin O’Leary reportedly did, he might get his money back. That will not help him in court though.

.png)