Weekly Reflection for August 4, 2023

- Serene Point

- Aug 3, 2023

- 5 min read

The Week - An Update in Charts

Cold water was splashed on markets on Tuesday when Fitch Ratings downgraded the U.S. government debt from its Prime rating. (See more on this below.)

A strong Friday rally fizzled even after a handful of technology companies posted strong earnings and a jobs report indicated a slowdown in hiring, which is key for the Federal Reserve to have reason to leave interest rates steady in September.

On Tuesday Michael Arone of State Street Global Advisors shared these expectations on the corporate earnings season. Noting that companies have been struggling with growing quarter-over-quarter earnings since last year, we may have hit bottom for the negative news. The next two quarters are forecast to show positive growth. Two sectors with some of the best prospects - technology, which has endured 5 quarters of disappointing earnings, and financials - are moving back to high single-digit growth.

Interest rates are at the highest level in 22 years and have pulled everything else up with them, except for maybe returns on money market accounts.

The 30-year fixed mortgage has reached 7.49%, which is still not as high as the average rate since 1971, which is 7.74%.

The Federal Reserve of Philadelphia officially recorded in its Beige Book the bump in revenue in its region that corresponded with Taylor Swift's three-evening engagement at Lincoln Financial Field in May. Moody's has noted that tourism in the U.S. has declined year-over-year except for cities that Taylor Swift has toured.

And then there's still Beyonce to consider, whose U.S. tour only just kicked off on July 12th in Philly. Her massive stadium show is already giving off healthy economic vibes in the regions she has visited.

The U.S. has one bank for every 71,000 residents. We used to have twice as many. Consolidation has been on the rise since the 1990s and will continue for good reason - it is hard to compete with the behemoths like JP Morgan Chase and Bank of America. The downfall of Silicon Valley Bank panicked clients of small and medium-sized banks who moved their money to the bigger shops, even if their own banks were not in danger. The deposits flowed largely to "too big to fail" gigantic banks.

Smaller outfits face the choice of either raising yields on deposits, borrowing from the Federal Reserve at today’s high rates or merging to survive.

How hot is it? So hot that a black bear sought refugee in a jacuzzi at a Southern California residence late last month.

It is so hot that Amazon workers are striking, Michigan is giving construction workers time off and Orlando utilities are postponing gas-leak checks due to the heavy gear workers must wear to stay safe. The cost to the economy in 2020 was $100 billion. That is expected to rise to $500 billion annually in the next 30 years. Sectors most negatively affected include agriculture, construction, manufacturing, and hospitality.

A Bust of a Downgrade

After Fitch Ratings, the credit rating firm, downgraded the U.S. government debt from AAA to AA+ on Tuesday, the stock and bond markets sold off. Fitch was calling the government out for its shenanigans after the drawn-out debt ceiling debate, one of many this century, and overall “erosion of governance” when it comes to how our country manages its finances.

Many took issue with the timing of the announcement given that the economy seems to be doing okay and the debt-ceiling was lifted in June for another 18 months after agreements to rein in some fiscal spending. But Fitch listed many reasons for its decision.

The ratings firm sounds very irritated with Congress for its repeated fights over spending and threats to default on debt payments. It admonished lawmakers for having no medium-term plan and says that the process is overall too complex. The “steady deterioration in standards” and the massive run-up in debt without meaningful progress in tackling expensive programs like Social Security and Medicare (which are 33% of the total budget) are leaving the U.S. vulnerable. Read the full report here.

The White House and U.S. Treasury Secretary Janet Yellen quickly put out statements sharply disagreeing with Fitch’s decision. Wall Street

tended to agree, saying that Fitch’s decision was merely a passing headline and nothing to worry about. J.P. Morgan’s CEO Jamie Dimon said it “didn’t really matter” in an interview with CNBC. Economist Mohamed El-Erian said he was puzzled and figured the action would be “dismissed.”

And then there were those who recommended that the powers that be take note. It “should be a wake-up call” said the president of the Committee for a Responsible Federal Budget. Then, also on CNBC, Stephen Schwarzman, the CEO of Blackstone Inc. a trillion dollar institutional money manager, said that it does matter because the government does not have discipline and our debt has exploded since the Great Financial Crisis of 2007-2009. Even Warren Buffett, who shrugged off the immediate impact of the announcement, warned that Fitch’s concerns were valid.

The rating does not currently have any bearing on the fact that the U.S. Dollar remains the world’s reserve currency. It is a safe bet when times are good and bad. The dollar has remained highly predictable in value, liquid and stable, since the Bretton Woods Agreement in 1944 deemed it the world’s official reserve.

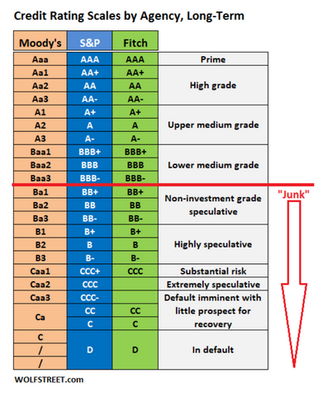

Fitch is one of “big three” credit rating agencies. Its decision leaves the U.S. with just one AAA perfect score from Moody’s. In 2011, Standard & Poor’s downgraded our sovereign debt to AA+ after a bruising debt ceiling battle and has yet to upgrade it back to AAA.

Bankruptcy Talk is Hot

There are some new “meme” stocks on Wall Street this summer. These are the stocks of companies without meaningful revenue, earnings, and sometimes even a product. But the worse the news gets, such as a declaration of bankruptcy, the better their stock seems to perform.

The most eye-popping uptrends are currently in Rite Aid (its business is weighed down by billions in debt and executives are exploring options, including

bankruptcy), Tupperware (which has suffered falling demand and negative earnings for years) and Yellow (the trucking company which has already stopped operating in face of pending bankruptcy).

There are two main drivers of the upsurge in price and volume. One isinvestors covering their short sales by buying back shares, and driving up the price. Investors “short” or sell stocks when they feel that the price is too high given the business’ prospects; the intent is buy it back when it falls lower and book a profit. This technique, beloved by hedge funds and other large institutions, does drive a stock higher for a moment as those investors buy to close out their positions.

The other driver is those fanatic Reddit message boards like WallStreetBets where millions of investors rile each other up to drive momentum to trading a company's stock en masse. Following the chatter or the trending stocks is popular even amongst institutional investors who have learned that the mom-and-pop trader deserves attention.

The action in Tupperware, Yellow and Rite Aid might not have anything to do with mom-and-pops this time. The heat map of trending WallStreetBets doesn't register any of these names in the last 30 days. Maybe this trend really is due to institutional investors digging for quick bursts in performance. It still meets the definition of a meme even if the professionals would rather not be seen as stooping to that level.

.png)