Weekly Reflection for August 5, 2022

- Serene Point

- Aug 5, 2022

- 5 min read

Market Update

Over 50% of the S&P 500 index components have reported earnings and more than half issued results that exceeded analysts' predictions. But both Morgan Stanley and Bank of America say that it might be too early too celebrate, despite the rally in stocks over the last 5 weeks. After all, the economy is still weakening.

The housing market is souring with both buyers and sellers getting fussy. Buyers are backing out of deals more frequently and sellers are only reluctantly reducing prices to induce bids. Higher interest rates are getting more blame than the staggering 44% increase in values over the last two years.

Inflation has not yet eased and will not be getting any help from the strong job market. The unemployment rate is back to pre-pandemic levels and employers are still looking for even more workers, particularly in the construction, leisure and hospitality sectors, while wages continue to grow – up 5.2% over the last year. The healthy employment picture, but perhaps a tad disappointing to those who want the Federal Reserve to stop increasing interest rates. That is not likely to happen yet; rates will be raised again at the next Fed meeting in September no matter what the July inflation number is when it is released next Wednesday.

The market has almost reflexively moved back into what it has been comfortable doing for the last decade. Growth stocks have rallied on the expectation that the Fed is going to be forced into reversing course by lowering rates sooner rather than later. This is in tandem with a belief that the recession, or slowdown if recession is too strong a word, will be economically mild and short-lived. Other market prices concur that imminent doom is not around the corner.

Junk bonds, debt issued by companies with very weak financials, are trading at slightly higher spreads but nothing extreme. In the more stable government bond market, the benchmark 10-year Treasury yield remains lower than shorter-term yields, as indicated by the blue line in the left chart. This is called inversion and the persistence of inversion signals a recession; still, the spread between the yields is not wildly alarming.

While commodities prices continue to fall, a sign that consumers will be consuming less due to their own personal economic worries, prices have recovered recently. The Bloomberg Commodity Spot Index, which tracks 23 energy, metal and crop futures contracts, has rebounded after losing more than 20% in June and July.

All this to say, economic data is weak and weakening, but investors are coming to terms with it and determining that all may not turn out so poorly. The rally is about buying up some of the companies that were punished early and hard this year – like technology and media, consumer discretionary and communications. It may also be about the belief that in a struggling world, the U.S. is the safest bet.

Buybacks

In 1982 the SEC agreed to allow publicly traded companies to purchase their own shares in the secondary market without being charged with stock manipulation. “Buybacks” are now an incredibly common practice. Companies in the S&P 500 index repurchased $862 billion of their own shares 2021, a record amount. This year, as the market dropped, companies furiously snapped up shares, outperforming their non-buyback peers in the process.

Shareholders love the practice as it boosts the price. Executives, who make the decision on how and when to craft buybacks, also clearly love it. Per SEC data, executives unload more shares of their corporation stock in the eight days following a buyback than during any other time.

The practice has plenty of critics who complain that companies should reinvest that money into products, workers and facilities that would boost company revenues over the long-term. Congress is not enamored with the practice either. As part of the Inflation Reduction Act of 2022, a 1% excise tax on stock buybacks would be imposed on corporations. The S&P 500 barely moved on the news, leading some to figure that Wall Street was not too worried about the impact.

As a work-around, some analysts suggest that corporations could just increase quarterly dividends by more than usual. Or they could surprise the market with “special” dividends – a one-time drop of cash to shareholders. For recipients, dividends are taxable when paid into a brokerage, non-retirement, account, unlike buybacks, which come at no realized tax to shareholders.

Social Media's Tide

There are plenty of reasons to be concerned about the woeful ethics of a company like Meta, the parent of Facebook and Instagram. For millions of users, the platforms have delivered a toxic mix of bullying, self-esteem torpedoes and cutthroat politics. So it is refreshing to learn that the platform has also led to the upward mobility and increased incomes for many, per a new study in the journal Nature. Thanks to some 21 billion friendships available to dig through, because of course Meta has no problem sharing that data about you with others, the researchers were able to draw some interesting lines around the economic dynamics between 72 million Facebook users aged 25-44.

Their conclusion was that friendships across varying socio-economic classes led to better outcomes for those born into the lowest income groups. They were more likely to graduate from high school and less likely to have teen pregnancies. Incomes were 8.2% higher than they would have been otherwise. No surprise, though, location matters.

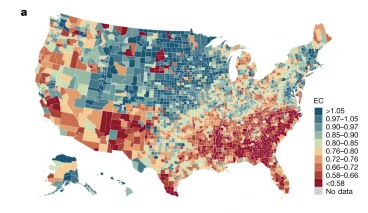

Focusing on the most populous counties, the researchers looked for economic connectedness (EC), or the integration of people from different financial backgrounds. They found that in areas heavily segregated by race and income, poorer children had less opportunity to improve their lots. Economic connectedness is lowest along the southern half of the U.S. It is the highest in the rural Midwest, think the Dakotas and the surrounding states, and on the East Coast.

When young people were able to mix with others from different economic backgrounds in high school, the neighborhood or church, better life incomes were achieved. Another interesting outcome has been that for those who started out poorer and moved up the income strata, they kept friendships and connections with others from their lower-economic circles. This connection has been like a tide coming in to pull up the ones below them, leading to continued upward mobility.

Whether Facebook is to "thank" for this positive outcome or just merely the means by which the researchers are able to explain some upward mobility, it is not noted in the study. But it is likely that making real in-person connections along life's way, keeping them going via virtual uses of Facebook and the like, have led to meaningful improvements in the quality of life for millions of people.

.png)