Weekly Reflection for December 9, 2022

- Serene Point

- Dec 9, 2022

- 4 min read

Market Update in Charts

The most recent stock rally that began in early November seems to have lost steam. It seems likely, based on history, reason and current conditions, that the current bear market will persist until the widely-expected recession is here.

The year has seen the steepest drop in U.S. bond prices in the last 120 years, maybe even since the beginning of American bond issuance. As a result, yields on some issues have tripled since the beginning of the year. Purchasing CDs and bonds in the last couple of months has become attractive again after a decade of painfully thin coupons.

The Producer Price Index, which measures what domestic producers are earning for their goods and services, indicates prices are declining but not as fast as expected. Next Tuesday we get the Consumer Price Index and economists expect it will "only" rise .3%, slower than the previous .4% monthly increase.

Chipmakers are coming home to the U.S. Even companies with homes in other countries are setting up shop on U.S. soil. It takes many years and many billions, to setup a chip factory. But companies are exhausted by thedifficulties of globalization. The trade-off for more control with factories closer to the consumer will be the cost - everything with a chip will now be much more expensive.

You can ignore those panicky reports that say there are not enough holiday trees for every home that wants one. The Real Christmas Tree Board says that is not true and never has been. Although data is not formally collected, there are some 20 million trees available every year. 87% of people find one to take home on their first try.

If the rush and stress of getting a real tree is too much, an artificial tree is a good plan, especially since the supply shortages of 2020 and 2021 have been worked out. However, you can only eat the real one after the holidays are done.

Some people are struggling with the high price of food and gas. Others are struggling to feel safe wearing watches that cost into the thousands. Watches are extremely attractive to thieves who do not mind using a little violence to get what they want; Paris now has a 30-member force dedicated to timepiece theft. The spike in robberies has had a knock-on effect for some of the most sought-after watches from Rolex, Patek Phillipe and Audemars Piguet, which have seen sharp declines in prices.

Human Cost of an Energy Crisis

Keeping warm this winter comes with a complicated set of consequences. For some, burning dirty fossil fuels means people will die from the pollution. On the

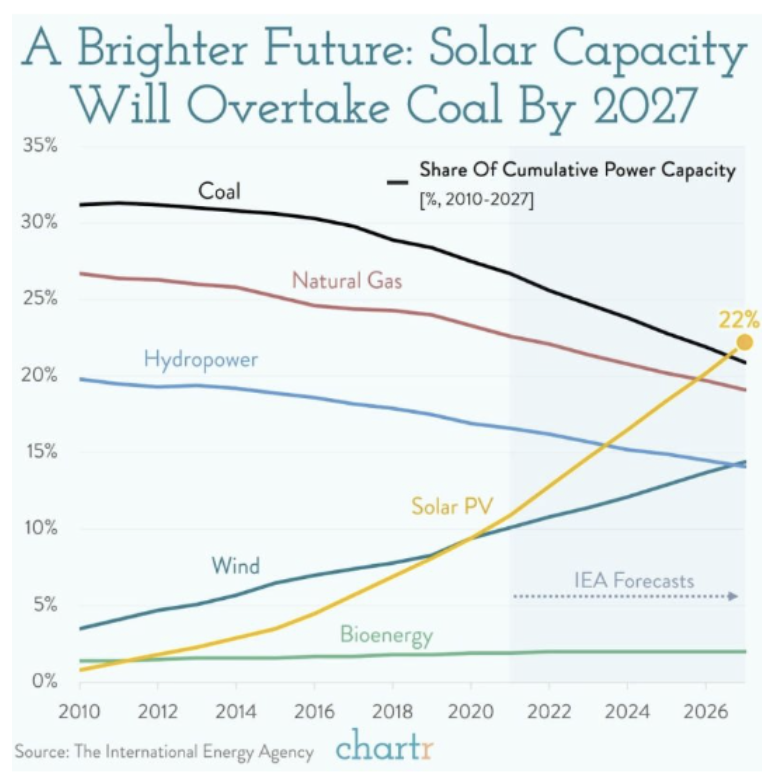

other hand, being cold runs the risk of causing death too. This week the International Energy Agency is predicting that solar energy use will surpass all other forms of energy. (Nuclear was not included in their report.) If accurate, it cannot come soon enough for the millions of homes still burning fossil fuels for heat.

Take Poland, which is ramping up coal production in a desperate effort to keep its people warm. Of the 100 cities with the worst air quality, 40 are in Poland. The government is suspending restrictions on burning just about anything there and handing out protective masks. It is an ugly bargain between keeping warm and clean air, and warmth is winning. Over 40,000 Poles have died prematurely in recent years due to pollution according to Poland's own records.

Elsewhere in Europe, governments are taking steps to keep residents warm, alive and less indebted to energy companies. What The Economist has studied and what governments are acting on is the understanding that expensive energy bills have a high correlation with preventable deaths from cold and illness. European Union member states will hand out some $600 billion this year to help homeowners and businesses keep the thermostat to a comfortable temperature. Between October of this year and next April, The Economist forecasts 75,000 lives will be saved. At the same time, European lives will be lost to pollution, and as noted in their report, deaths will spike in other poorer countries that will be forced to go without energy that they can not afford.

The Pop of the At-Home Investor's Portfolio

There were many big stories in 2020 as far as investing went and amongst the biggest was the rise of the "retail" trader. Call them "mom and pop" or "meme" traders. Whatever the term, the face behind the trades was a newly enamored, work-from-home, regular person flush with stimulus cash and extra time on their hands due to Covid-19 restrictions.

But after seeing profits through most of 2021, these investors are having a rough go navigating 2022. Per Vanda Research, which studies the group, the average non-professional investor has lost 30%. By comparison, the S&P 500 has lost 17%.

One strategy that may not have worked in their favor, which in fairness can be a profitable maneuver in some circumstances, was to "buy the dip". Investors who were aiming to scoop up stocks after a market rout were not rewarded. There have been several rallies over the year, as many as seven depending on what metrics are used to evaluate, but stocks have continued to drop further in subsequent retreats. Another strategy, buying what has worked in the past, has not panned out. Investors focused on the hot stocks of the last few years, like technology, SPACs, cryptocurrency, and the meme stocks, have found these securities to be a huge disappointment. The chart here shows the fate of some of the most widely held and most popular technology companies that previous ruled with stellar returns, until a year ago.

But the retail investor is remaining optimistic, per a survey by Finimize. Of 2,000 responses from Europeans, Asian and American investors, only 1% plan to sell in 2023; most will keep on investing and nearly 30% plan to increase their stock investments. 72% plan to stick with what worked before 2022 - they are still eyeing the mega firms from the chart above - Apple, Microsoft and Meta and even crypto. Let's hope they have learned some lessons about the importance of diversification and fundamentals.

.png)