Weekly Reflection for February 10, 2023

- Serene Point

- Feb 10, 2023

- 5 min read

The Week - An Update in Charts

U.S. stock indexes were mixed this week and only the Dow Jones Industrial Average notched a gain. This is a trend change of sorts. The worst performing companies of 2022, and often those with the worst financial metrics, have led the rise forward. This has helped the Nasdaq move up double digits in 2023. However, investors might finally be heeding the hawkish notes of the Fed, which insists rates will still rise and stay high in 2023. Another worrisome indicator is the bond yield curve which remains inverted, meaning yields on short-term issues are above longer-term issues, a long-standing signal that a recession is looming.

Goldman Sachs noted three things the biggest U.S. corporations have in common as they layoff thousands of employees. First, they are primarily in the technology sector. Second, they over did it on hiring during pandemic, increasing headcount by an average of 41%. Third, their stock prices have dropped some 43% from recent highs. Microsoft, Meta (Facebook), and Amazon are among the most extreme cases. However, Goldman notes that

these companies laying off employees are the exceptions, not the norm, as most businesses are still hiring.

While tech companies are laying off employees most other businesses, especially small companies, are hiring. Many workers have not returned or are just getting around to it. Participation in the labor force rate is still below pre-pandemic levels. This means that wages could be pressured down with more supply, leading to more disinflation, to use the latest economic buzz word.

The US economy added 517,000 jobs in January, a huge number, and much higher than the 188,000 bean-counters were expecting.

The IRS has been tracking crypto holdings for a couple of years now, taxing gains and any interest earned. Bad news for those crypto customers who have their investments locked up by a bankruptcy but received any interest on their holdings in 2022 - they will still likely owe income tax on the earnings. The IRS tax code stipulates that "income is considered taxable as soon as it is earned".

The National Retail Federation (NRF) has surveyed thousands over the last 10 years to ask how consumers will consume the Super Bowl, which is this Sunday between the Philadelphia Eagles and the Kansas City Chiefs. As much as $16.5 billion will be spent on celebratory events and NRF says that is more than last year but still not as high as pre Covid levels. The ads never get cheaper though; some 30-second spots snagged $7 million for Fox Corp, which is airing the game.

Update on Residential Housing

The residential real estate market has not become the disaster that many predicted when mortgage rates doubled last year. Instead of home pricesflopping, CoreLogic says overall valuations were 6.9% higher in December 2022 than in December 2021. What did go off a cliff was the total number of transactions, down 34% last year. It was a combination of homeowners not willing to sell at reduced prices and buyers not desperate to purchase.

Low inventories of available homes are propping up valuations. This is a boon for homebuilders who still seem very shy after the big burn of the Great Financial Recession fallout nearly 15 years ago. While they are moving through their cautious process of buying up land and developing as much as their own business models will allow, it is not enough to close the ever-widening demand gap.

On the other side of the fence, foreclosure activity is growing. As ATTOM, a property data company, sees it, filings are up, even as the full cycle from first notice to final

paperwork takes on average 28 months. The Covid-era policies, as allowed in the CARES Act, helped homeowners with forbearance, or the ability to pause mortgage payments. This pushed down foreclosure numbers for a few years.

None of this information is even remotely helpful to first-time home buyers in some of the nation's hippest metro areas. To save for an average home on an average

salary and looking to put away just 10% for a downpayment will take years. Or decades if you are living in L.A. or San Francisco. Zillow considered a 5% savings rate to come up with these timeframes. A solution would be to save more, downsize

house expectations or just look somewhere, anywhere ,else! An "average" house in San Francisco costs $1.2 million per Redfin.

Trading on Inside Info

If someone uses “Congress” and “trading stocks” in the same sentence, there is a good chance that they are talking about a powerful person trading on inside information. Politicians and their staff regularly get private briefings and, of course, set policies that impact businesses in all manner of ways. They frequently meet with high level business leaders and are privy to information that no one else has. Thus it makes sense that there are rules against using any non-public information to trade and make money ahead of others.

The STOCK (Stop Trading on Congressional Knowledge) Act of 2012 intended to punish Congressional members if they were found trading in certain securities and required regular self-

report on security trading. The law was substantially pared down within a year making it nearly useless. Business Insider says it has identified 78 members of Congress who recently violated the law.

Last month January Senator Josh Hawley introduced the Preventing Elected Leaders from Owning Securities and Investments Act; he likes to call it the PELOSI Act. Its sister bill in the House of Representatives has bi-partisan support and is being shopped around as the Transparent Representation Upholding Service and Trust in Congress Act, or TRUST Act. Both bills would require congressional members and their immediate families to place all of

their investments into a blind trust for third party management.

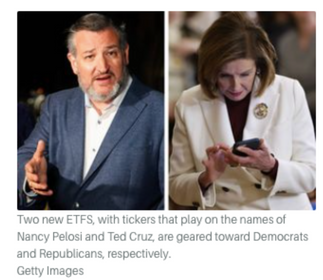

For those everyday investors who want to trade like a high ranking politician can consider two new Exchange-Traded Funds from the data firm Unusual Whales and advisor Subversive, The tickers NANC and KRUZ invest in the same stocks traded by currently sitting Democrats and Republicans in Congress. Thematic funds like this can attract and lot of attention and money at first but gimmicky investing can be hard to sustain. Investors attracted to shiny objects may not stick around and managers might find, after the initial rush of enthusiasm, that it is too expensive to keep fund operating. And now this new legislation that looks to take trading permissions away from our elected lawmakers will also make it tough to know what they are in vesting in. They,

ostensibly, will not know in real time either!

.png)