Weekly Reflection for July 21, 2023

- Serene Point

- Jul 20, 2023

- 5 min read

The Week - An Update in Charts

In late May, the S&P 500 Index return was being propped up by just seven companies with massively strong performance. Most of the other 493 companies' stocks in the S&P 500 were losing money for the year.

Now the good vibes have spread out. Only 35% of the S&P 500 components have negative year-to-date returns.

The S&P 500 equal-weight index weights returns of all companies the same, regardless of size. It is now out-performing its peer that gives much more weight to the heavies, such as Apple, Microsoft and

Amazon.

All 11 business sectors are positive since the end of May. Beaten up energy and financials are finally getting some appreciation from investors who are ever so slightly moving away from richly valued

technology companies.

Imports from China are falling as compared to Mexico. Twenty years ago Mexico suffered after China entered the World Trade Organization in 2001. Since 2017 and the Trump Administration tariffs, imports from China have faltered and it seems to have been to Mexico’s benefit. The largest portion of Mexican products that the U.S. imports are auto- related.

Used car prices are dropping. If you have been eyeing an electric vehicle and do not mind getting a "previously loved" model, the prices are in your favor. Analysts say consumers have Tesla to thank. The company is marking down its new cars at such a fast rate that used ones are flooding the market, giving buyers an upper hand that they have not had in many years.

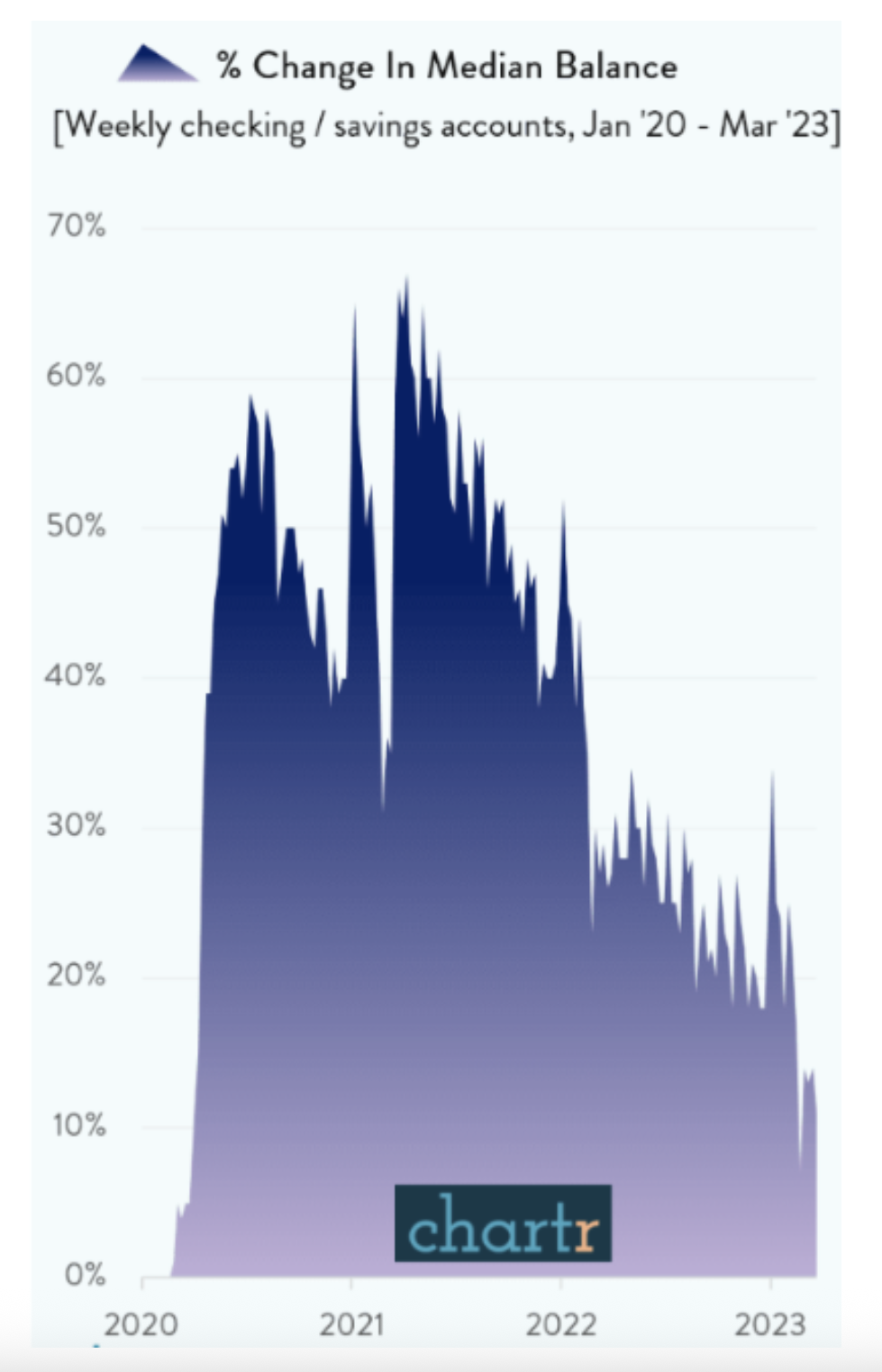

While savings are dwindling, the good news is that US households still have some 10% to 15% more savings than before the pandemic. The less good news is that the accounts are dwindling, per new information from JP Morgan, who says this trend crosses all income brackets. For some, lower inflation will help stem the leaks. For others, the restart of student loans this fall will shrink the accounts even further.

Today marks the 10th positive day in a row for the Dow, its longest streak since September 2017 and a rise of 4.5% since July 7th. Today in history, 90 years ago, Wall Street was considering the effects of President Franklin D. Roosevelt’s “New Deal". The Dow suffered one of its worst ever daily losses, plummeting 7.8% (or 7.55 points) to close at 88.71. It was not a lasting loss. The markets recovered steadily until a recession in 1937 knocked them down again.

Retirement Easter Egg Surprises

Digging through the retirement provisions that Congress updated last December remains a chore and a reckoning for many. It was full of Easter eggs, you know those surprises that you find much after the Easter holiday. Sometimes the egg can be a good surprise and sometimes it stinks. One provision that was updated is the “catch-up” contribution to 401(k)s for those ages 50 or better. Older employees can contribute more than younger savers and starting in 2024, 60-year olds can put away even more. For example, today a 30-year old can put $22,500 into a 401(k) and a 50-year old using the catch up can put in an additional $7,500 for a total of $30,000. Starting next year, a 60-year old can add $10,000 in catch-up contributions.

So, these options are hugely helpful for savers who find themselves behind in prepping for retirement. According to statistics shared below, that is most everyone in the U.S.

Here's the Easter egg – starting in 2024, if an employee makes more than $145,000, the catch-up must be contributed to a Roth IRA. This is an apparent attempt by the government to make sure that they do not lose too much tax revenue while trying to help pre-retirees save extra. Roth contributions are taxed before contributed, unlike their sibling "traditional" retirement contributions, which are not.

So those making catch-up contributions and earning over $145,000 are now going to pay taxes on their retirement savings during what is likely their highest-earning years, rather than paying tax on withdrawals in retirement, when they may be in a lower bracket.

The whole reason for the catch-up is to catch up. No matter how you slice it and who you ask, Americans are woefully behind on saving for retirement. Per

Vanguard, the average balance for a person in their mid-60s is $280,000. That is better than it was, but far behind even the most basic advice, which is to have $1,000,000. The one million number is the bland rule-of-thumb for middle-income Americans who do not want to ever return to work after retirement, which it seems would be everyone.

While the Roth IRA and Roth 401(k) are wonderful tools, they are best used by those in lower tax brackets with many years to go before retirement. Withdrawals must be taken after a 5-year waiting period, or the earnings are subject to taxes and penalties. The more one pays in tax on the ccontribution, the longer one has to wait to make that up in earnings on the money just to break even, which is usually at least 5 years.

But this change might just dovetail with another financial planning tactic that older Americans are turning to with more enthusiasm – leaving the Roth IRA to the kids and grandkids instead of using it. This gift is tax-free to heirs, who have a requirement to withdraw the money within 10 years. Grandparents pay the tax; grandchildren get a lift in their wealth.

Another Sports + Money Edition

This time we are looking at the quietest biggest tournament on the planet being played in Australia and New Zealand this month. The FIFA Women’s World Cup soccer tournament (or football to the other 6 billion on the planet)started yesterday in Australia and New Zealand. It has been off to a rather low key start in the U.S. sports news. Much more print, and video, is going to golf (the British Open is currently underway) and NFL news (although the season does not officially start until September).

Some 2 billion people will be watching the Women's World Cup in the next 30 days, basically the same number of people who watch the Olympics. (To compare, the British Open gets maybe 5 million viewers and American football averages 17 million pairs of eyeballs in a week.) Globally interest in all women's sports has been steadily rising over the last couple of decades and the FIFA Women’s World Cup is the most valuable women’s competition of any sport. Thus, there are dollars attached to every aspect of this event and making the most of all those viewers.

Australia could earn $400 million in tourism inflows and New Zealand could see $60-100 million or more. FIFA sold a lot of the viewing rights but will still earn $100 million from advertisers; another $200 million will be earned by networks around the world. Even the players are getting a boost in income.

Australia could earn $400 million in tourism inflows and New Zealand could see $60-100 million or more. FIFA sold a lot of the viewing rights but will still earn $100 million from advertisers; another $200 million will be earned by networks around the world. Even the players are getting a boost in income.

.png)