Weekly Reflection for March 17, 2023

- Serene Point

- Mar 16, 2023

- 5 min read

This Week - An Update in Charts

Another week, another wave of speculation about the strength of the world's economic system and betting on what the Federal Reserve will do about interest rates at next week's meeting. After the European Central Bank raised its rate another 1/2 percent, the Fed likely has ammunition to keep going, for now. But belief that we are coming to the end of the rate-hiking cycle, finally, is part of the reason that the stock market has any green on the board at all.

Other assets, like bonds (prices shot up), oil (prices plummeted) and gold (up 6% since last Friday) are sending signs that many investors expect more pain, at least in the short-term. Bonds and gold serve as shelters in rough times. Oil drops on premise that the world will slow its activity down.

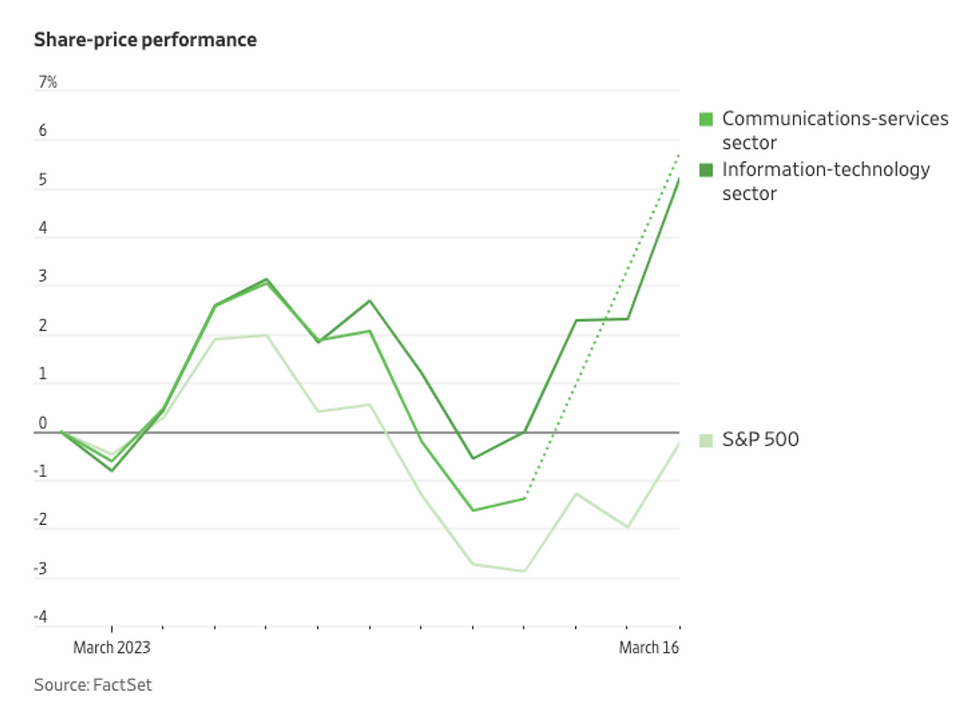

Technology stocks are the reason for the "green" on the board. Just about the only group of stocks that has not been completely rattled by the banking sector's strike, worries about inflation and higher interest rates is technology, flying high after the complete beating these stocks took since November 2021. As of March 2nd, the tech sectors have outperformed the broader S&P 500 Index every day, the longest streak since July 2017. In fact, if the technology stocks were removed from the S&P 500 Index's computation, it would be in the red year-to-date.

The "shelter" component of the overall inflation number is one-third of the entire calculation. The increase in housing costs was responsible for 70% of the overall lift in February's monthly inflation. The strong job market contributes to landlords' abilities to stand firm and raise rental prices.

More supply is on the way. The number of new multi-family units like

apartment buildings that began construction last year was the highest since 1974. It takes about 15 months to get a building finished.

Since 2009, oil production in the U.S. has steadily increased. President Biden recently signed approval for drilling to begin on three sites in Alaska's North Slope. The amount of oil produced there will be only 1.5% of the overall U.S. production, but will help push the country further into "net exporter" territory. The U.S. is now the largest producer and consumer of oil products, with 20% of the world's total in each.

We have been trimming our buying ever since the holiday season. February saw big drops in purchases of home goods items, housing materials and autos, popular purchases that had contributed heavily to inflation over the last 2 years.

The Philadelphia Fed's Manufacturing gauge in February seems to concur, painting an ongoing slump in manufacturing in the U.S. This monthly number gives a snapshot of current business health and a near-term forecast of future health. Manufacturing has a cold; we will watch to see if it develops into something more serious.

Spending on St. Patrick's Day is back! After taking a dip the last couple of years, revelers plan to spend on green things - clothes, cups and plates and beer. Some 32 million Americans claim Irish ancestry. They will be joined by another 150 million in the U.S. that are happy to do a little jig and eat a little corned beef with their pint.

Peeling the SVB Onion

Lots of ink has been spilled trying to peel the onion of what went wrong at Silicon Valley Bank (SVB) and how to determine whether this is our sub-prime loan crisis of 2023. Intense fear has hit the markets, which have taken a “sell now, ask questions later” approach to owning bank stocks. The key to understanding where the next shoe may drop is in knowing what likely caused SVB to fail.

There are a few characteristics that stand out at SVB that are not inherent in other banks.

1. For starters, they have/had a specialized niche of clients. SVB catered to start-up technology companies that are notorious for burning through cash. Throughout 2020-2021, these businesses stockpiled dough from venture capital investors and government pandemic policies. In 2022 as the Federal Reserve cranked up interest rates and

business conditions got more challenging, these companies started pulling out money faster than they were depositing.

2. SVB invested in U.S. Treasuries, considered the safest security on the planet as backed by the full faith and credit of the United States. However, SVB held too many low-interest bonds and failed to replace them with higher interest bonds during the rising rate environment of 2022. As the value of their low-yielding treasuries fell, SVB was left holding treasuries that were worth less than they paid for and getting less in interest than the market was offering. Concurrently they were being pushed to raise the amount that they paid customers on savings deposits in order to keep clients happy. On the 8th, SVB filed an 8k with the SEC that showed the income earned from their treasuries was less than 2% but the interest paid on deposits was around 4%, a huge mismatch.

3. The clients of SVB do have a “hive” mentality. In most communities, people do not share where and how they bank out of a general lack of interest or enthusiasm for a normally ho-hum task in life. But for customers at SVB who fall mostly into the tight-knit community of start-up technology companies and their financial backers, banking is a hot topic. So once the word really picked up last week that SVB was short on cash, venture capitalists fired off messages and burned up phone lines asking their start-ups if they were exposed. Founders reportedly then spent hours and hours trying to get their cash out. Although this was not the entire reason the bank failed, it was the knock-out punch. The demise of Signature Bank a few days later followed almost exactly the same storyline as SVB – entrepreneurial clients who had been withdrawingmore than depositing assets. Their clients were spooked by SVB, withdrew more money and left Signature bleeding with no investment portfolio backstop. (In a you-can't-make-this-stuff-up twist, none other than Barney Frank of the Dodd-Frank Act banking legislation was a sitting board member of Signature. Read his somewhat chaotic interview with The New Yorker here.)

There is surely more to be learned and the crisis has not completely passed, even if the immediate shock of it has. And the lessons are rather pedestrian - know your vulnerabilities and diversify. It is nothing new but clearly easy to forget.

The city of Chicago turns the Chicago River green for just one day every March 17th. Hundreds of thousands of visitors ooh

and ahh at the banks as part of the annual ritual of celebrating St. Patrick, who brought Christianity to the Irish a thousand years ago.

Chicago is keeping its secret of the their special dye ingredients for good reason. It is so simple and perfect, a prankster could have a good time if they knew the formula. How the green dye became a tradition has its roots in river sewage.

In the early 1960s, Chicago’s new mayor was disgusted by the river and wanted to find the source of the contamination. His administration poured a concoction into the water that would allow them to see exactly where, and hopefully who, was using the waterway as a dumpster. The city’s St. Patrick’s Day Parade chairman got a glimpse of this action and convinced the city notto just streak the river but go full on green for the big day. The river remained green for a week that year.

Over the following years the officials tinkered with the formula and made it environmentally friendly. Now the process has been perfected. An orange powder is sprinkled into the water in just the right amount to make the river green for a few hours. Revealing the formula would be akin to a leprechaun revealing where it hides its gold, say city officials; it’ll never happen.

.png)