Weekly Reflection for October 21, 2022

- Serene Point

- Oct 20, 2022

- 5 min read

Market Update in Charts

The markets are trying, led by the 30 behemoth companies in the Dow, to make a break higher. The S&P 500 and Nasdaq have lagged over the last 2 weeks but all three indices are clocking big jumps up and smaller downside closes. Earnings announcements have not (yet) been terrible. Interest rate hikes, expected to be another 1.25% this year, could be slowing before long.

The price of crypto-currency Bitcoin has stabilized over the last several months after falling nearly 60% just this year. Its volatility is now below both that of the S&P 500 and Nasdaq, giving some hope that that buyers will return to the space.

As goes inflation, so do the IRS tax brackets. Most everything is moving up by 7%. The standard federal deduction is now $27,700 for married couples and half that at $13,850 for individuals. The six federal tax brackets have also expanded in acknowledgement that incomes are growing. On the downside, incomes will not get a break from the 6.2% social security payroll tax until earners collect $160,000 in wages.

Every comparison on economics and markets these days seems to reference the 1980s. The 8.7% increase in social security payments next year are the largest since 1981. This is great for seniors, and not so great for the program, which is already expecting to curb payments in the next decade.

The European Union is getting ready for winter and energy stockpiles look healthy. They must be pleased also by weather reports predicting a warmer than usual winter.

Silver Linings

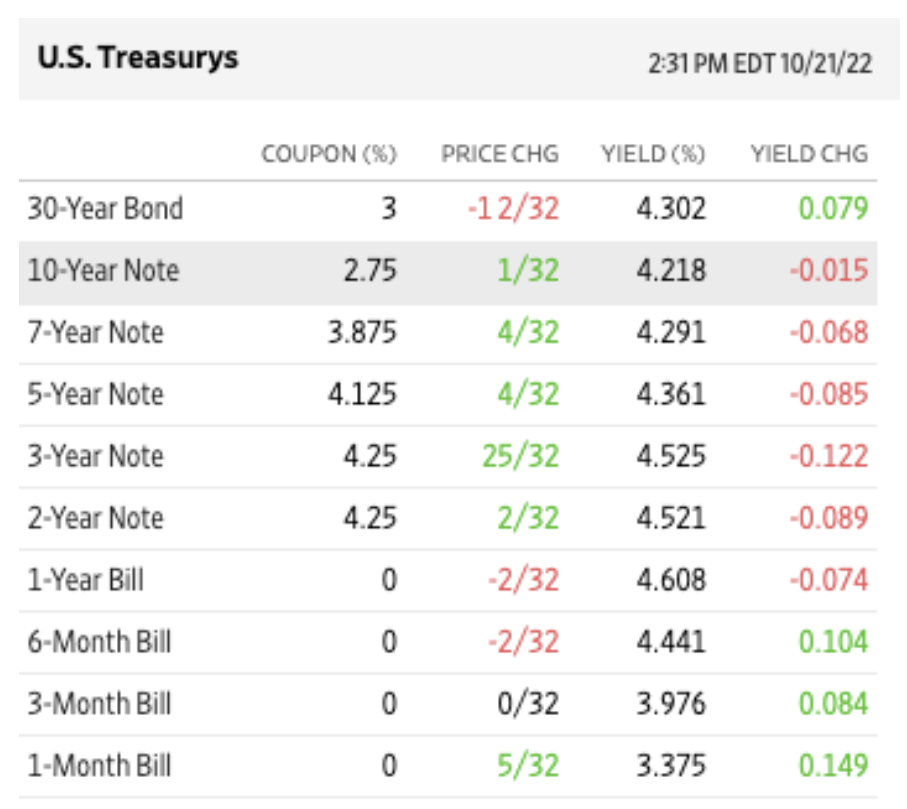

It has been a year. After the pandemic-driven downturn in economic fortunes, investors are paying the price for years of near-zero interest rates and government stimulus. But the silver linings are starting to appear.CDs, money market funds and bonds yields are finally looking appealing. At the beginning of 2022, a 5-year Treasury bill yielded just about 1.25%. As of today, it is yielding 4.36%.

Most stocks are much cheaper in the last 12 months. After years of worrying about putting new money into a market that looked and felt expensive but kept moving higher, investors have opportunities to begin picking up durable, dividend-paying, cash-flow positive companies at multi-year lows. Of course, it is possible that stocks will fall further as a world-wide recession remains a strong potential, but holding out for the bottom is rarely ever productive.

Tax-loss harvesting in non-retirement accounts by selling losing positions to lock in a loss, can be powerful for future tax bills. Off-setting losses by taking gains in other positions allows investors to realign their portfolios without worrying about the added expense of taxes, when done properly. Any losses that cannot be matched with gains in a calendar year can be carried forward indefinitely, per current tax law.

Looking forward, inflation does appear to be coming down. After rising 50% during the height of the pandemic, used cars sales fell over 10% over the last year. Home prices are falling, which is a relief after rising some 25% in the last year alone. A barrel of oil has fallen

23% from June highs. Another critical commodity, wheat, has fallen 33% from the June high; although production has fallen in Ukraine and the E.U., on a net basis it has improved around the world. Many investors, and businesses, have locked in borrowing at low-rates and have the ability to earn higher yields on cash. A look at publicly-traded businesses shows debt secured at 2-3% for many years to come. The same is true for homeowners with mortgages. A housing crash ala 2007-2009 does not look to be on the horizon. Less than 10% of mortgages are adjustable this time around, compared to 80% in 2008. 50% of homeowners own their home outright and the vast majority of the rest are locked in or have refinanced in the 2-4% range.Since the end of 2019, consumers and businesses have endured a pandemic, a war on the edge of Europe, political infighting, natural disasters and intense racial divisions. It is remarkable how resilient our economic infrastructure has

proven to be.

An Election Do-Over

If nothing else, the U.K. does seem okay with switching things up. The Conservative Party is in the process of choosing another Prime Minister, the 6th in five years, since Liz Truss has not worked out. It was only early September, two months after Boris Johnson resigned as the United Kingdom’s Prime Minister, that Liz Truss was chosen to succeed him. The vote is a convoluted process that whittles down candidates over time by the 172,000 dues-paying members of the Conservatives, also known as the Tories. A brief timeline of Truss' tumultuous time in office, just 45 days, give or take looks like this:

Sept 5th: Liz Truss secures votes to become Prime Minister

Sept 6th: Officially meets Queen Elizabeth and gets the go-ahead to form a new government. The PM appoints Kwasi Kwarteng as the Chancellor of the Exchequer (the equivalent role to Janet Yellen’s as Secretary of Treasury)

Sept 8th: Queen Elizabeth dies, leading to the suspension of parliamentary business for 13 days

Sept 23rd: With Kwarteng, announces her economic vision, dubbed Trussonomics; the plan is complete with windfall tax cuts for corporations and the wealthy to be paid for with massive borrowing

Sept 27th: British pound drops to record low against the U.S. dollar and investors sell government bonds, pushing the Bank of England to step in as a buyer. Worries intensify given the U.K. already has a massive debt load

Oct 3rd: Truss and Kwarteng walk back some of the plan, reinstating the 45%

income tax bracket that had been erased.

Oct 14th: Pick your version – either Truss sacked Kwarteng or he resigned.Either way he's out and was replaced the same day by Jeremy Hunt. Hunt promptly announced that the entire plan was being scrapped, while Truss sat behind him in parliament, a foreshadowing moment of her future sacking.

Oct 20th: Either Truss resigned, or she was sacked, after receiving notice of "no confidence" delivered by her Conservative Party leaders.

What’s next for the U.K.? Well, Truss asked for a new government to be formed within a week, apparently not willing to wait, as Boris Johnson did for two months, for another leader to be determined. She’s about as unpopular as the scandal-ridden Prince Andrew, “and you generally don’t tend to come back from Prince Andrew territory” said Matthew Goodwin, a professor of politics at the University of Kent.

It is not all doom and gloom. The FTSE has outperformed the S&P 500 year-to-date by a substantial margin. For all of the economic woes brought by the mess of the U.K.’s decoupling from the European Union and the effects of the war in Ukraine, businesses are doing okay. The U.K. is primarily an exporter, realizing most of their revenues in a strong U.S. dollar, and most of their expenses in the weak pound. Earnings estimates for British companies are moving higher, unlike businesses in most every other country.

.png)